Since Satoshi Nakamoto conceptualized it in 2008, blockchain served initially as a public ledger for Bitcoin and all its transactions on networks. However, soon many people began to realize that blockchain technology could hold the potential of benefiting a range of industries.

Today, we live in an era where permissioned blockchains are being used in financial services, healthcare, video games, energy trading, and supply chain management. Moreover, with blockchain technology, enterprises are able to unlock ways to automate various business processes.

According to a recent study by Finances Online, the growth rate for the blockchain market was 10.27% in 2020, and global spending on blockchain technology is projected to grow at a CAGR of 46.4% by 2024.

Furthermore, the global blockchain market size is expected to grow from $3 billion in 2020 to $39.7 billion by 2025. Moreover, as of February 2021, over 620.369 million transactions on blockchain have been recorded. In fact, experts predict that blockchain will boost global GDP by $1.76 trillion by 2030.

In light of this information, let’s take a quick look at some of the ways blockchain technology is influencing the banking industries of the world.

1. Customer Privacy

While IBM may have been bullish at first, Amazon, Microsoft, and Samsung have all launched their own blockchain services. With third party organizations monitoring and storing personal information, the need for privacy in current times is sky-high.

As blockchain has already shown with the help of Bitcoins that it can protect and secure valuable information from being exploited, many banks are using their own tailor-made blockchains to add an additional layer of protection for customer privacy. Examples include the likes of JPMorgan and Citi bank, which have already deployed blockchain into their operations.

2. Date Integrity

Banks and institution operating in the financial sector deal with tons of valuable data that is extremely volatile and in the wrong hands can turn out to be quite hazardous. This is why all recorded information must entail data integrity because, without it, costly information can be lost or suffer.

Data integrity enables the accuracy and consistency of data over its entire life-cycle and it is undoubtedly a critical aspect to design and implement. With blockchain technologies, such can be easily accomplished. In fact, several use cases are available where blockhains are used to digitize KYC (know your customer) and AML (anti-money laundering) data and keep track of transaction history and automate data verification.

3. Easy Transfer of Funds

Sending money from one place to another requires a lot of verifications, and the process can take time to complete. In fact, the process can be made even lengthier with various fees for both banks and customers being applied. In the current age of information and technology, such time lags are not appreciated.

Blockchain can make quick work of all such processes by offering a faster payment method and lower fees around the clock. An example can be taken from crypto wallets that enable customers to receive and send digital assets worldwide, including Electrum and Exodus.

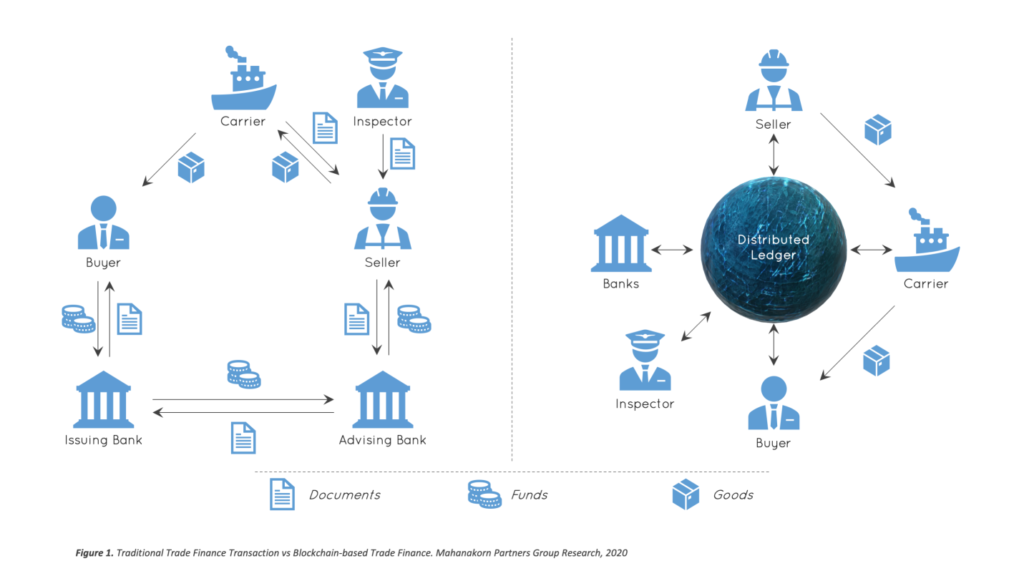

4. Financial Services and DLT

With banks operating around the world examining blockchain technology for their own particular use case, DLT (Distributed Ledger Technologies) have effectively infiltrated the financial services sector. DLT can be established as a far related cousin of blockchain that can help corporations establish better governance and standards for data sharing and collaboration.

In fact, DLT nowadays is evidently impacting an over $5 trillion baking industry by offering various uses cases, including clearance of settlements, fundraising, payments, and offering security. With the help of Blockchain and DLT operations involving trillions of dollars are being sloshed around the world.

5. Information Security

Even very basic blockchain security ensures trust in transactions where each data is structured, and each block contains a transaction or a bundle of transactions. Blockchain technology has the power to produce not only a structure for data but also imbue it with inherent security qualities.

Private and permissioned blockchains thus can be made very rigid with additional rules and policies. Private blockchains are restricted and usually limited to business networks. Permissioned blockchains are limited to a select set of users who are granted identities using certificates. As such, blockchain, while not being a panacea, can offer tremendous support to your primary and secondary measures of security.

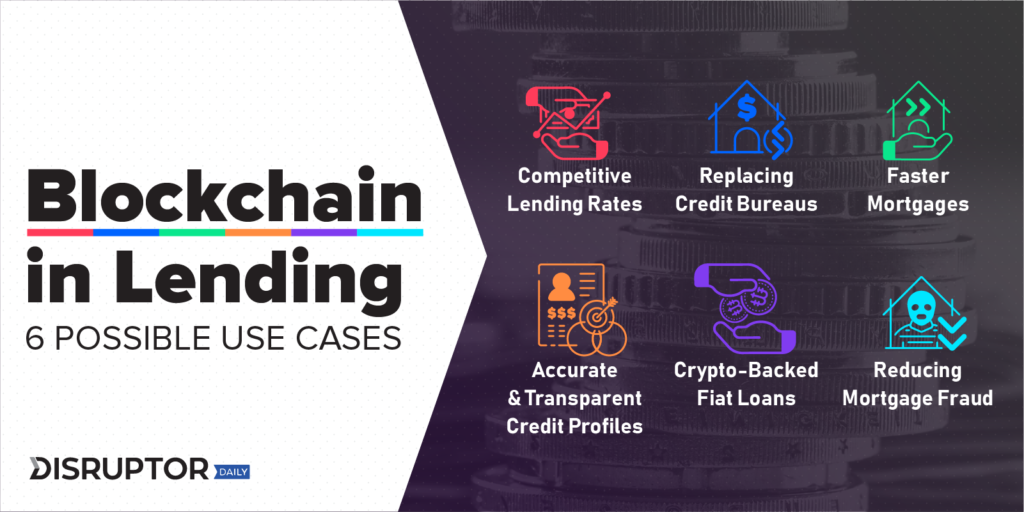

6. Lender Benefits

The process of borrowing money today is not only exasperating but are also quite expensive. Banks most definitely take advantage as, over the years, they have monopolized the lending sector. However, with blockchain technology, all of this can change by developing a new type of lending ecosystem.

This is also known as DeFi or Decentralized Finance, where it aims to put all financial applications on top of blockchains. For example, in peer-to-peer finance, blockchain can allow anyone to borrow and lend money in a simple, secure, and inexpensive way regardless of any arbitrary restrictions. This will eventually make the lending landscape more competitive and offering better terms for borrowers.

7. Prevention of Fraud

As the professor of finance at American University’s Kogod School of Business, Casey Evans proclaims that blockchain can be used for fraud detection. This is because blockchain enables the sharing of information with all the participants in real-time, and therefore all transactions are made visible.

In such a case scenario, LIBOR (London Interbank Offered Rate) can be protected from scandals involving manipulation of benchmark values and easily detecting false or fraudulent data.

Furthermore, by storing customer information on decentralized blocks, blockchain technology can make it easier and safer to share information between financial institutions. Pupils who opt for an essay writing service are advised to keep themselves protected from fraudulent activities online.

8. Raising Funds in the Private Sector

Entrepreneurs who are looking to raise money will historically depend on outside financers. This can include angel investors, bank loans, and venture capitalists. The process can be rigorous and can even contain the ever mundane negotiations that can be lengthy and time-consuming. However, blockchain technology can change all that.

Through ICOs (initial coin offerings), we have observed that blockchain can allow companies to sell tokens in exchange for funding and avoid massive fees for facilitating business securitization.

With DLTs already becoming applicable in financial services, blockchains can be used to raise a terrific amount of funds along with regulation and policies in check. At Student Essay, blockchain is used to generate funds and implement greater transparency in the business process.

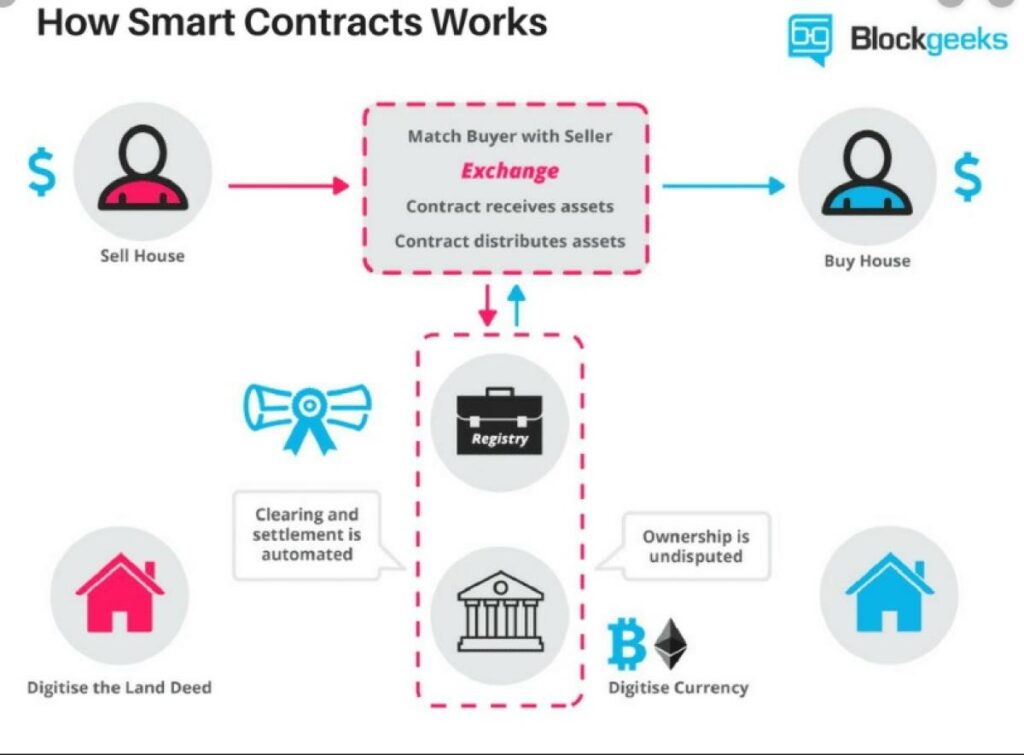

9. Smart Contracts

Smart contracts are simply put computer programs that can operate as a transaction protocol that is intended to execute or control a document legally automatically. This can also include relevant events as well as actions according to the terms and conditions mentioned in the agreement or contract. With the help of blockchain, banks can enforce trustworthy agreements through smart contracts.

Furthermore, blockchains can be programmed in such a way that they can execute reliable automation of the business process. Moreover, with the availability of smart contracts, the element of trust needed to reach an agreement can also be reduced along with minimizing the risks such as the odds of ending up in a courtroom meeting. This is because smart contracts offer a way to ensure compliance with laws which is again a value-added benefit.

10. Transparency & Trust

The very basis of blockchain technology is based on a shared ledger. This brings a lot of transparency in the process where all transactions that were made and are being made to be recorded and stay visible. A decentralized ledger means that all transactions are identically recorded in multiple locations. This also makes a blockchain extremely hacking-resistant as well.

A blockchain can create a single shared source of truth with a standardized and shared process that all network participants can follow. With transparent ledgers, different parties can collaborate and come to agreements quickly due to the high value of trust amongst each other. Not to mention that the system itself benefits by sustaining a high number of transactions while supporting interoperability.

Conclusion

The interest and motivation to deploy blockchain technology for banks are overwhelming, considering that private blockchains are much more manageable and boost operations tremendously. Furthermore, many banks are now considering opening their own research labs to study the use of blockchains further to increase the efficiency of their operations and reduce costs.

I hope this post was able to offer you a meaningful understanding of how blockchain technology nowadays is creating an evident impact for banking industries around the world. If you have any queries regarding the topic, feel free to leave a mention in the comment section below. That’s it for now. Cheers, and all the best for your future endeavors!

Author Bio

Stella Lincoln currently works as the Assistant Editor at Crowd Writer. This is where higher education students can acquire professional assignment writing services from experts specializing in their field of study. During her free time, she likes to doodle, create wall art, and practice mindful yoga.