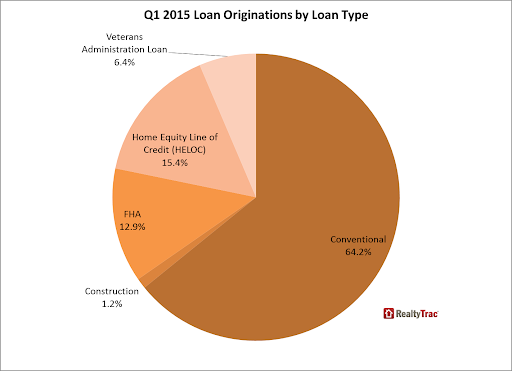

High-rise condo loans, especially in the U.S, are either insured by the government or traditionally funded via conventional banking. However, in order to build high-rise buildings, you have to qualify for any of the two loans through a tedious process, both of which are somewhat similar but have their own set of restrictions and limitations to foresee.

Building a condo has its own set of rules, known as overlays in real estate. These overlays vary from lender to investor; therefore, those of the government might differ from conventional banking ones. To know which one is the best for you, given your current situation, we have explained both FHA (government) loans and conventional loans below before you make a decision to construct a high-rise building in the States.

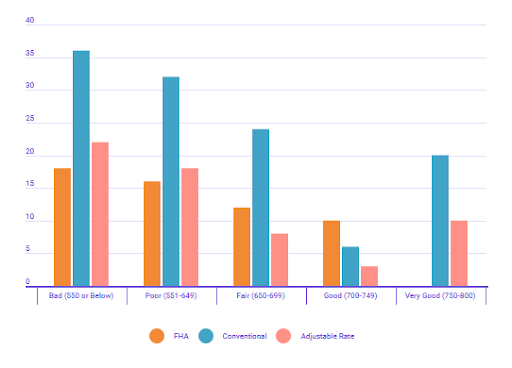

Credit scores are required for purchasing a mortgage with both FHA and Conventional loans as shown in the graph above.

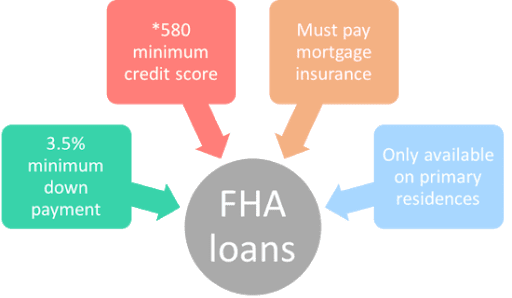

FHA Approved Government Loans

Investing in condos seems reasonable for first-time investors, typically. Therefore, investing in a high-rise building via FHA loans seems the only way to go due to lower finance rates and downsized down payments.

To apply for an FHA loan, you have to be FHA qualified in accordance with the standards and eligibility criteria for the approval of your application process. Here are the Requirements of FHA loans in a nutshell.

-

FHA Approved Condominium

In addition to your qualifications for the FHA loan, you have to make sure that the condo is enlisted on the FHA Approved Condo list as required by the HUD. If your interested property is not mentioned on the list or approved by the lender, opt for conventional financing as it’s the only way out.

-

Consider the Distance from your Principal Residence

Before investing in a property, make sure that the distance from your principal residence isn’t that far off since you can get disqualified before you begin to make your point. Lenders usually prefer borrowers from the same state or located at a distance that doesn’t disrupt the operations of the construction.

Lenders also prefer funding investors who plan to stay in the high-rise building as owners or occupants instead of leasing it out for acquiring a majority of rental income. Most lenders require leasing FHA loans to investors who plan on treating their condo as their permanent residence.

-

Percentages of FHA Loans and Condo Units

Approximately, 80% of FHA loans are approved if the investor occupies at least 51% of the housing units in the entire condo as an occupant himself instead of renting them to tenants.

-

Date to Completion of Construction

After acquiring FHA loans, the investor will have a year’s time span to complete the construction project without any pending additions. The initial purchases will be dealt primarily in cash or via conventional means alternative to FHA financing routes.

You have to open a reserve funding account that will be responsible for covering capital requirements including insurances for the following two years.

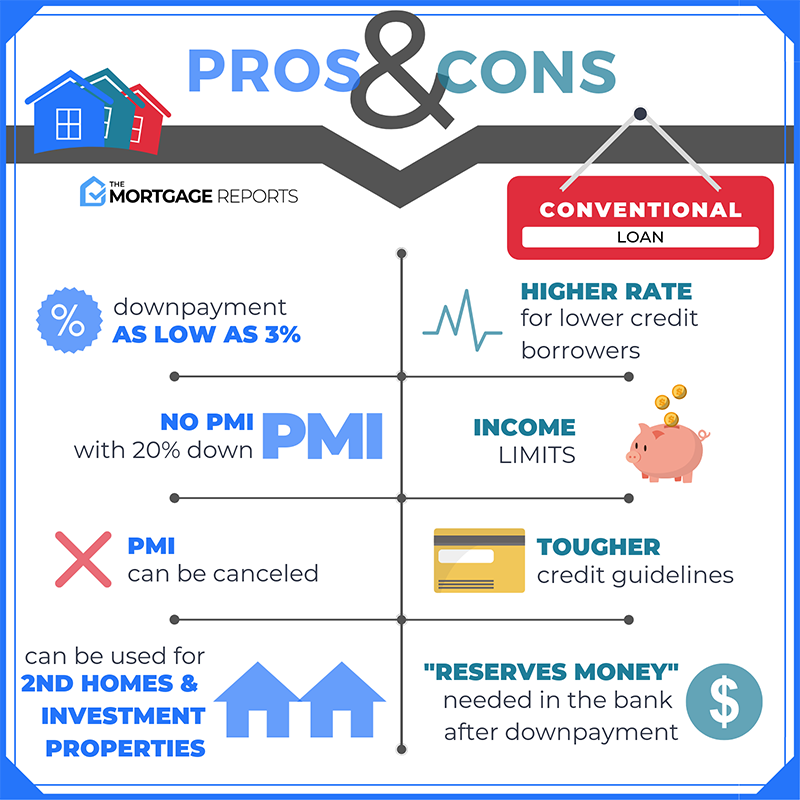

Conventional or General Condo Loans

While you have to show a good personal credit history of 680+ to qualify for a general condo loan, these loans have low interest rates with negotiable down payments for proceeding with the mortgage.

However, you’d have to give proof regarding your income source in addition to the submission of your financial statements and assets for the past two years. Below are the guidelines of conventional loans for real estate.

-

Homeowner’s Association Finances

Every unit in the complex is checked for ruling out any HOA related discrepancies. Approximately, 85% of HOA dues have to be cleared before the bank checks the status of the remaining units lined for garnering short sales or foreclosure in the building.

-

Resolution of Pending Lawsuits

The bank will check your legal documents including your financial statements before qualifying you for the application process. If the building you’re investing in has pending legislation in line, then the bank has the authority to stop the lending process until the lawsuits are resolved.

Banks usually don’t process the application forms for pending legislation, mainly because these lawsuits are time consuming and warrant a lot of expenditure for their resolution.

-

Insurance Liabilities

As an investor, you have to guarantee that you’ll maintain and cover all insurance liabilities of your high-rise complex. From covering insurances of natural hazards such as earthquakes and floods, you have to make sure that your condo wouldn’t suffer if any of these insurance companies falter to cover your expenses.

The Final Verdict

From securing the lease with a 20% down payment to enjoying the luxury as a first-time real estate developer, investing in a secure high-rise building has its own perks. You can also opt for paying a large-sized down payment to escape paying regular monthly payments. You can build the equity on your home by saving on your returns so that you can negotiate for a better mortgage and comparatively pay for a condo with a reasonable home price.